WPP AUNZ releases 2019 full year results and strategy for growth

WPP AUNZ Limited today announced its financial results for the year ending 31 December 2019 and launched its new corporate strategy to return the business to growth and market leadership.

Summary

• Results in line with previous market guidance.

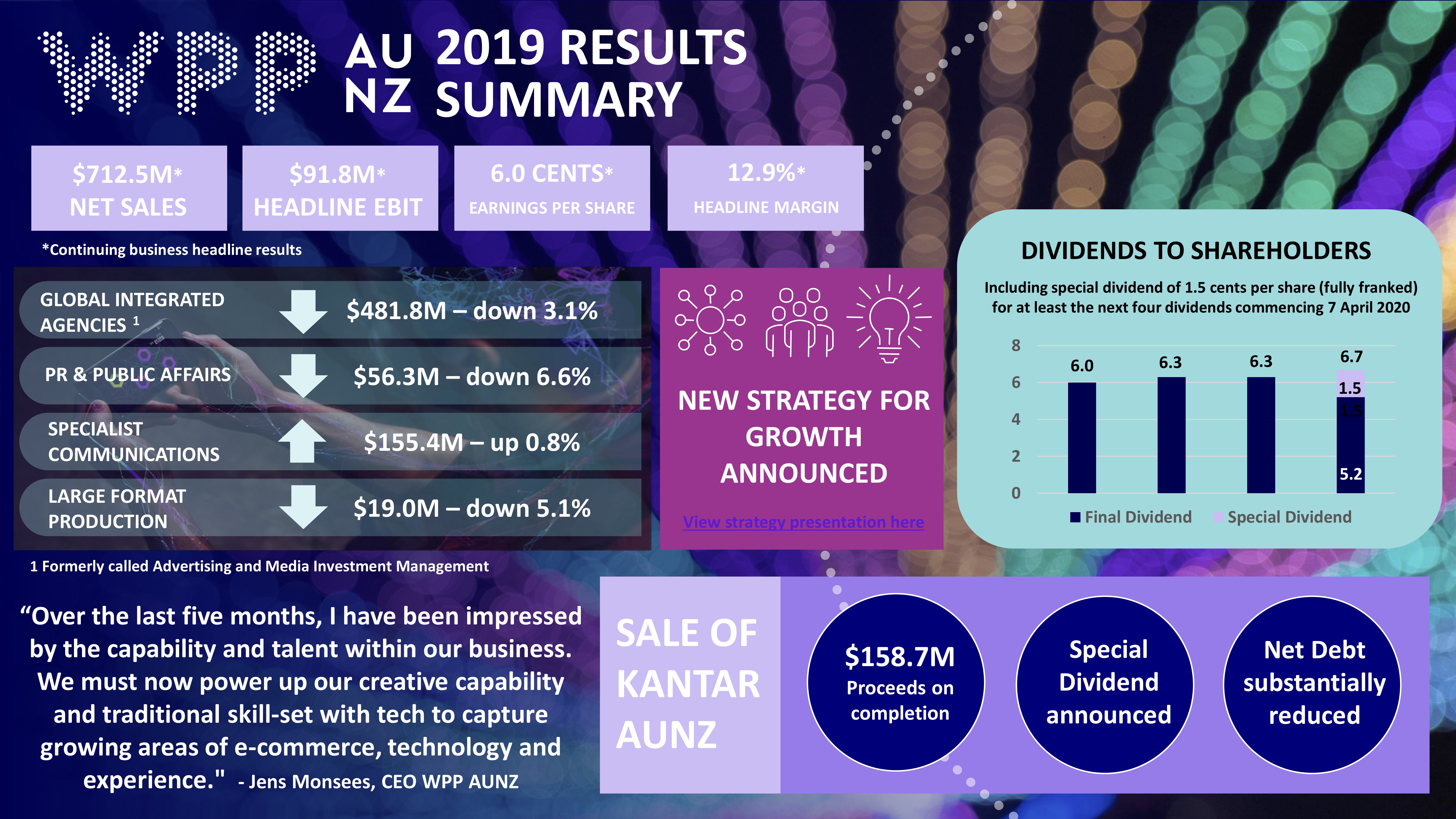

o Total headline EPS of 7.4 cents, down 9.6%. Continuing1 business headline EPS was 6.0 cents,

down 9.6%.

o Total net sales of $819.4 million, down 4.4%. Continuing1 business net sales was $712.5 million,

down 2.6%.

o Strong cashflow conversion of 98% over last 24 months.

o Significantly reduced net debt (post the Kantar AUNZ sale). Leverage reduced from 1.9x to 1.1x

net debt/Continuing1 Business Headline EBITDA.

• Within the reporting segments, certain brands within the Global Integrated Agencies (formerly Advertising

and Media Investment Management segment) and the Public Relations and Public Affairs segment

suffered from account losses and a continued weak advertising and media market environment.

• The Specialist Communications segment, which includes technology brands AKQA and Aleph, achieved

strong performance consistent with trends across markets globally where clients are investing more

heavily in marketing and advertising technology.

• Successful completion of the sale of Kantar AUNZ for $158.7 million in December 2019, tax of c.$5m to

be paid in 2020.

• Sale proceeds of Kantar AUNZ used to reduce gearing, return funds to shareholders through a special

dividend announced today; and invest in the Group’s new growth strategy.

• Special dividends of $50 million announced with 1.5 cents per share paid for the next four dividends,

every six months commencing April 2020.

• Final ordinary dividend declared of 2.9 cents per share. This brings total ordinary dividends for the year to

5.2 cents per share, representing a payout ratio of 70% of earnings. The Board’s target payout ratio has

been maintained at between 60-70% of headline earnings per share.

• New strategy to transform, strengthen and grow WPP AUNZ in Australia, New Zealand and South-East

Asia. Focus on clients, operating model, platform, people and solutions and geographies.

• The Group has already commenced the transformation phase of its strategy announcing a new leadership

strategy, restructuring of its New Zealand operations and establishing a Centre of Excellence to consolidate the technology consulting operations of the Group.

Says Jens Monsees, managing director and CEO: “Over the last five months, I have been impressed by the capability and talent within our business. We must now power up our creative capability and traditional skill-set with technology to capture growing areas of e-commerce, technology and experience. As technology advances, the way consumers connect and communicate with brands is also evolving rapidly and that is why today we have announced a new strategy to simplify and scale our business and capture the new growth areas of the advertising, media and communications market.

“It is a strategy that will significantly change our operating model.

“Our path to growth will be undertaken in three phases – transform, strengthen, and grow – over a three-year period to 2022.

“This year is the transformation phase of our strategy. Now two months into 2020, I can say we have already made meaningful progress in this phase by announcing a new leadership structure, a restructuring of our New Zealand business, added capabilities in technology through the acquisition of Dominion in New Zealand and announcing the establishment of our Centre of Excellence to consolidate the technology consulting operations of the Group.

“Our team is intent on being a true partner of choice for our clients, creating a shared services platform, and attracting and retaining the best talent in the market.

“Key to our success will be relentless execution and creating avenues for growth. We have new solutions technology and data capabilities, and campuses to drive better client service and a strengthened geographic footprint into South-East Asia.

“We are confident in our ability to change gear and create a future of opportunity and success. No-one in our market is yet leading the future of consumer communication and that is where we want to be. We believe we are strongly placed with our creativity and technology capabilities to become the leading creative transformation business in Australia, New Zealand and South-East Asia.”

Strategy for Growth – transform, strengthen, grow

WPP AUNZ’s new strategy for growth will be executed across six key areas:

1. Operating model

Restructure our operating model to bring fewer, stronger brands to our clients and make it easier for them to navigate our services. We are establishing a Centre of Excellence (to consolidate the technology consulting operations of the Group) to bolster our capabilities in data, marketing and advertising technology and consulting.

2. Clients

Improve the organisation of our capabilities across brands around client needs through dedicated client

leads, sector practice areas, and a new incentive scheme.

3. Talent

Establish a new leadership model, roll out a new incentive scheme, and invest in specific talent to support

our digital technology capabilities.

4. Platform

Support our strong brands and manage costs by implementing a shared services structure of HR, IT, Finance, legal, marketing, and communications.

5. Solutions

Bolster our capabilities in e-commerce, experience, and technology through partnerships with platforms, scalable solutions and selective strategic M&A.

6. Geographies

Leverage our current presence in large and growing markets of South-East Asia by growing our capabilities in those locations to support our businesses in Australia and New Zealand. In Australia and New Zealand, we will expediate our campus approach with the goal of bringing brands together in one location in most of our major cities.

We will drive to deliver greater value to shareholders through the transformation period by delivering earnings growth through a focus on three areas:

1. Organic revenue growth

2. Operating margin improvement

3. Targeted acquisition program

Our objective is to accelerate organic net sales growth over 2020-2022 through:

• Expansion of solutions to include experience, commerce and technology. This will be supported through the

establishment of the Centre of Excellence focusing on technology, data and consulting.

• Expansion of existing client engagement and new client wins through a more coordinated approach to client

engagements, the establishment of client leads and creation of key city campuses.

We are targeting operating margin improvement of 2% to 3% over the period to 2022. The specific areas targeted are 1) shared services; 2) right sizing the cost base; 3) property; 4) production; and 5) external spend.

The new strategy requires an expansion of our capabilities in technology, data/Artificial Intelligence and consulting. We are retaining balance sheet flexibility to fund the transformation strategy and allow for acquisitions through a targeted program over 2020-2022. We expect incremental profit from those acquisitions to contribute to headline earnings per share growth over the period.

Successful completion of the sale of Kantar and return of funds to shareholders

Kantar transaction completed on 6 December 2019. Transaction valued Kantar at $168 million – multiple of 8.2x Kantar’s 2019 budgeted EBITDA. Proceeds on completion were a receipt of $158.7m. Tax relating to the Kantar transaction of c.$5m to be paid in 2020.

In determining the use of proceeds from the sale of Kantar, the Board has balanced returns to shareholders with a reduction in debt levels, adopting a conservative approach given the transformation strategy and uncertain economic backdrop, whilst ensuring that we provide capacity for investment in the Group’s future growth.

The Board intends to return approximately $50 million to shareholders through a 1.5c per share fully franked special dividend for the current dividend payment and each of the next three subsequent dividend payments. These special dividends are on top of our existing and continuing ordinary dividend policy of a payout ratio of 60 – 70% of headline net profit. The remainder of the sale proceeds will be used to pay down the Group’s debt, and provide flexibility to invest in the new growth strategy.

In determining the announced capital management initiatives, the Board has initially taken a conservative approach on the back of the Group’s current leverage and the intention to operate at the lower end of our stated target gearing ratio of 1.5 – 2.0 times, the excess franking credit balance position, the earnings outlook, and our anticipated funding needs for the new strategic plan.

Financials – performance of Continuing Businesses

The financial results of the Continuing Business are presented excluding the impact of significant and non-cash items, and excluding the results of the two major units disposed in 2019 – Kantar and Ogilvy NZ.

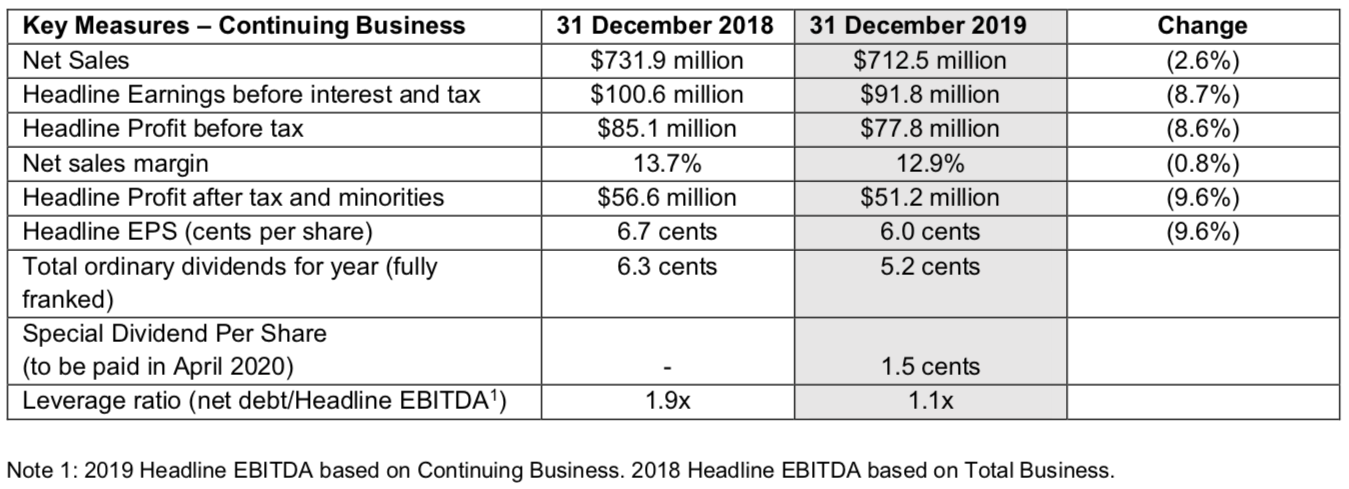

Continuing Business contributed net sales of $712.5 million converting to Earnings Before Tax of $91.8 million at a margin of 12.9%. Continuing Business Headline earnings per share was 6.0 cents which was a decline of 9.6% on prior year, in line with guidance.

The Global Integrated Agencies segment faced headwinds in 2019 due to some brands in the segment having global and local accounts losses. This has been amplified by a weak media market and economic conditions throughout the year. We expect 2020 to continue to be a challenging environment for this segment.

The performance of certain brands from the Public Relations segment declined in 2019. Overall this segment has been performing strongly over a number of years and the outlook for the segment remains positive, with the expectation it will return to growth in 2020.

The Specialist Communications segment comprises digitally focused businesses and have delivered organic earnings growth in 2019. The digital businesses contained within the specialist segment are growing and well positioned for further growth, both locally and in South East Asia.

Progress has been made in restructuring the Large Format Production segment. The improvement is reflected in the earnings, which is primarily driven by a strong second half performance creating momentum for 2020, and is a result of restructure actions delivering cost and operational efficiencies. The largest of these savings were generated through property consolidation and improvement in its overall supply chain. The benefit of the initiatives is an improvement in the quality of its operations and enhanced customer experience, that will drive client retention and growth in the future.

Operating cashflows remain strong with cashflow conversion of 98% over the last 24 months, and 91% over the last 12 months.

As a result of the receipt of the proceeds from the Kantar transaction, net debt has been significantly reduced from $270.3 million at 31 December 2018, to $121.4 million at 31 December 2019. The Group’s leverage ratio was 1.1x, a reduction from 1.9x at 31 December 2018. Our targeted leverage range remains 1.5x to 2.0x.

Impairment of Intangible Assets in the first half of 2019

As announced at the half year, the Group recorded a large impairment charge relating to intangible assets. The impairment charge for the 2019 year was $297.6 million (before tax) for the Total Business. This impairment charge relates to acquired intangible assets including brand names, customer relationships and goodwill. The impairment charge predominantly relates to the segments of Global Integrated Agencies (formerly Advertising and Media Investment Management) segment ($249.7 million) and Data Investment Management ($44.3 million).

The impairment of Goodwill and Brand Names in the Global Integrated Agencies segment has been driven by a re-assessment of future cashflows and growth rates, reflecting the segments current performance and future earnings outlook. The impairment of Customer Relationships reflects the reassessment of the length of customer engagements.

The impairment within the Data Investment Management Segment reflects an adjustment to the carrying value of the assets to reflect the value of the assets in the Kantar transaction.

The impairment charges represent a write down of c.25% of the intangible asset value contained in the balance sheet at 31 December 2018. The impairment charges are non-cash in nature and have no impact on the Group’s debt facilities, compliance with bank covenants, payment of dividends or its ability to undertake capital management initiatives.

Dividends – 6% uplift in total dividends in 2019

The Directors have declared a fully franked final ordinary dividend of 2.9 cents per share, bringing the total ordinary dividend for the year to 5.2 cents per share (2018: 6.3 cents per share). This represents a payout ratio of 70% of the headline EPS of 7.4 cents per share. This is within the Board’s target payout ratio of between 60-70% of headline earnings per share.

The Directors have also declared a fully franked special dividend of 1.5 cents per share for at least the next four dividends (i.e. every six months) commencing with the current dividend payment. This special dividend program is in addition to our ordinary dividend.

The total dividends for the 2019 year are 6.7 cents per share, fully franked, an uplift of 6% on the prior year (2018: 6.3 cents per share).

Both the final ordinary dividend and the first special dividend will have a record date of 31 March 2020 and will be paid on 7 April 2020.

Summary and Outlook

Says Monsees: “Taking into consideration the considerable transformation that will be undertaken in the 2020 financial year, we expect to provide guidance on the 2020 outlook at the AGM in May 2020. It is too early to predict our full year result given the uncertain economic backdrop for our clients and the significance of our transformation strategy.”